Good Corporate Governance

Supporting Function of Board of Commissioners and Directors

To help the tasks of the Board of Commissioners and Directors, the Company forms several supporting functions: Audit Committee, Nomination and Remuneration Committee, Strategy and Investment Committee that works and supports the Board of Commissioners, meanwhile the corporate secretary and internal audit work and support the Board of Directors.

AUDIT COMMITTEE

Audit committee formed by the Company has the tasks to help the Board of Commissioners in ensuring the financial reports are presented fairly and in accordance with applied accounting principles and internal controls, internal and external audit implementation has met the standard audit finding results are been followed up and auditor external selection (including external auditor service fee) are already correct to be presented to the Board of Commissioners.

Audit Committee Working Guidelines

In conducting their tasks, Audit Committee has an Audit Committee Charter as their guidelines, that has been established by the Board of Commissioners. The charter is then utilized as guidelines for the Audit Committee in conducting their tasks and responsibilities transparently, competently, objectively and independently so it can be accounted and accepted by all parties interested. The Company Audit Committee Charter contains Structural Function; Member Qualification; Responsibility; Authority; Meeting; Report; Length of Service; and Annual Plan.

Member Qualification and Company Audit Committee Independency

Bapepam-LK regulations about Audit Committee requires that the Audit Committee consist of at least three members, one of them being the Company Independent Commissioner, which is chaired by Independent Commissioner David Emlyn Parry and Independent Commissioner Hartopo Soetoyo as one of the members. The other two members must be independent parties, one of them must have skills in accounting and/or finance.

To fulfil the independency requirements according to applied regulations in Indonesia, the Audit Committee members are not appointed from executive officials of the Public Accountant Office which provides audit services and/or non-audit services to the Company within six months.

Based on this principle, the Company appoints 2 (two) Audit Committee members who fulfill the independency requirement/no conflict of interests with the Company, in particular no family relationship, financial relationship, management relationship, and Company ownership.

Audit Committee Responsibility and Authority

The Audit Committee has to be responsible for providing advices and reports to Board of Commissioners if important matters were found and need attention from the Board of Commissioners, report issues related with tasks of the Board of Commissioners such as:

- To review financial information made by the Company, including financial report, and other financial information.

- To review Company compliance to applied laws and constitutions and manage Company activities as a public Company.

- To review the implementation of the internal audit examination result.

- To report to the Board of Commissioners all potential risks that may affect the Company and apply policy and risk management procedures assigned by the Board of Directors.

- To maintain confidentiality of Company documents, data and other information In conducting their tasks, the Audit Committee has the authority to access archives and information about staff, funds, assets and Company resources that are related to Audit Committee task administration. In conducting the authority, the Audit Committee works together with any parties that have been approved to conduct an internal audit.

Composition of Membership, Service Period and Task Division of Audit Committee Members

The Company Audit Committee consist of 3 (three) members and 2 (two) of its members have accounting or finance background and skills and headed by an Independent Commissioner and maybe adjusted with the Company complexity considering the effectivity in decision making.

Information on the composition and terms of office of the Audit Committee in 2022 are described in the following table:

| Name | Position | Basis of Appointment | Date of Appointment | Term of Office |

| Johny J. Lumintang | Chairman | Decree of the Board of Commissioners Outside the Meeting dated September 20, 2018 | September 20, 2018 | AGMS 2023 |

| Tavip Santoso | Member | Decree of the Board of Commissioners Outside the Meeting dated September 20, 2018 | September 20, 2018 | AGMS 2023 |

| Tufrida Hasyim | Member | Decree of the Board of Commissioners Outside the Meeting dated September 20, 2018 | September 20, 2018 | AGMS 2023 |

| Farid Harianto | Member | Decree of the Board of Commissioners Outside the Meeting dated Januari 11, 2018 | January 11, 2022 | AGMS 2023 |

Task Division of Audit Committee members as described below:

| Name | Position | Function |

| David Emlyn Parry | Head (Independent Commissioner) | Also as an Independent Commissioner and is responsible for all activities of the Audit Committee. |

| Tavip Santoso | Member (non-Company) | To be responsible in laws and compliance. |

| Tufrida Hasyim | Member (non-Company) | To be responsible in accounting and/or finance. |

Meeting of the Company Audit Committee can be conducted anytime when necessary. Discussion and decision taking in the meeting of the Audit Committee is documented in minutes which must be signed by all members of the Audit Committee attending the meeting. If the decisions or agreements can be achieved, the decisions will be taken by majority voting in which more than half of Audit Committee members attend. If the voting does not lead to decisions. the head of the Audit Committee needs to determine the result of voting.

During 2022, the Audit Committee have conducted 4 (four) meetings with meeting summaries as follows:

| Maret 15, 2022 |

|

| April 13, 2022 |

|

| December 6, 2022 |

|

| December 16, 2022 |

|

Attendance Recapitulation of Audit Committee members in the meeting as follow:

|

|

|

|

|

|

|

Johny J. Lumintang |

|

|

| Tavip Santoso |

|

|

|

| Tufrida Hasyim |

|

|

|

Brief Report on implementation of Audit Committee Activity

In 2014, Audit committee held 7 (seven) meetings and did many activities to help the Board of Commissioners in monitoring the Company’s operations and activities. Points of brief report regarding the activity of Audit Committee in 2014 are as follows:

- To survey and review audited financial reports by external auditors for toll road sector, port and water distribution from subsidiaries for financial year 2013.

- With Internal Audit Department, Audit Committee conducts visits to on-going projects in toll road sector, port, and clean water distribution to survey and evaluate technical performance, financial and commercial aspects from the project.

- Preparing field visit report by breading down findings and create recommendations for performance improvement and submitted to Board of Commissioners.

- Risk management procedure review and investment/divestment approval from the Company for new projects.

Remuneration Policy

The Company has a remuneration policy upon the Audit Committee. The amount of remuneration adapted to the arrangement at the Board of Commissioners and Board of Directors level. For 2014, the remuneration for the Audit Committee is in the form of special allowances, amounted to Rp 5 million per month.

Competency Development Program

In 2014, members of the Audit Committee Tufrida Hashim followed a competency enhancement program entitled “Integrated Risk Management”.

REMUNERATION AND NOMINATION COMMITTEE

Remuneration and Nomination Committee has tasks to help the Board of Commissioners in deciding selection criteria and preparing candidates of Board of Commissioner and Director members and its remuneration system. The Remuneration and Nomination Committee consist of several members which consists of the Board of Commissioner members and head by a Commissioner and/or professional from outside the Company. The Remuneration and Nomination Committee is under the Board of Commissioners. The committee is under and responsible to the Board of Commissioners.

Task and Responsibility

Task and responsibility of the Remuneration and Nomination Committee are as follows:

- To provide assistance the Board of Commissioners in deciding selection criteria for candidates of the Board of Commissioner and Director members and its remuneration system; and,

- To provide assistance the Board of Commissioners in preparing the candidates of the Board of Commissioners and Directors and proposing its remuneration amount.

Composition of Membership and Length of Service

| Name | Position | Start | End |

| David Emlyn Parry | Chairman | December 10, 2013 | AGMS 2018 |

| Helda M. Manuhutu | Member | January 15, 2014 | AGMS 2018 |

Brief Report of the KNR Activities

Throughout 2014, several activities have been carried out by KNR are as follows:

- Conduct a review of salary position at management level for Holding and Strategy Business Unit (SBU) to determine the suitability of salary position of Holding Management and SBU with the standard market salary in the same industry.

- Perform number of reviews and implementation of benefits for management at Holding level based on the reference of treatment in the market;

- Conduct a review of the Bonus Scheme proposal that applied in 2014 for 2013 performance;

- Follow several studies conducted by external parties who have expertise in the market survey of salary and benefits internal implementation, from the Holding level to the SBU and Business Unit (BU);

- Together with the Board of Directors to conduct review and preliminary selection to be submitted in the meeting with the Board of Commissioners and Board of Directors, later to be approved at the AGM for one (1) candidate for the Board of Directors. Selection and recruitment conducted in the early 2014; while the validation was done at the AGM on June 10, 2014.

Remuneration Policy

The Company has a remuneration policy for the Nomination and Remuneration Committee. The amount of remuneration adapted to the arrangement at the Board of Commissioners and Board of Directors level. For year 2014, the remuneration for the Nomination and Remuneration Committee is in the form of special allowance, amounted to Rp 5 million per month.

INVESTMENT AND STRATEGY COMMITTEE

Strategy and Investment Committee (SIC) formed by the Company have tasks to propose, review, direct and monitor the Company’s business development in conducting the Company investment policy and propose to the Board of Commissioners for approval. SIC consist of Director members. SIC formed by the Company with purpose to design an integrated plan, and integrated with the Company strategical competency toward environmental challenges. This plan is designed to ensure that the Company’s main purpose can be achieved through prompt and consistent actions .

Task and Responsibility

Tasks of Strategy and Investment Committee:

- To provide assistance in designing Investment Policy and Annual Investment Technical Instructions:

- To provide assistance to review and analyze certain investment/divestment proposals either to financial aspects, legal or other aspects by considering social, political, economical and environmental factors that develops when investment/divestment proposals are proposed;

- To provide recommendations for result analysis done to proposed corresponding investment/divestment proposals, accompanied by clear background and reasons regarding the proposals of investment/ divestment acceptance or rejection; and,

- To provide consideration in order to decide investment/divestment implementation as stated in number 1 and 2.

Composition of Membership and Service Period

In 2014, SIC composition are as follow:

| Name | Position | Start | End |

| Ramdani Basri | Chairman | August 21, 2013 | AGMS 2018 |

| Danni Hasan | Member | August 21, 2013 | AGMS 2018 |

| Dr. Scott Younger | Member | August 21, 2013 | AGMS 2018 |

Serving period of the Company’s Strategy and Investment Committee is from December 10, 2013 until end of serving period of the Board of Commissioners assigned in the AGMS on May 24, 2013.

Brief Report on implementation of SIC Activity

In fiscal year 2013, the Company’s strategic and investment committee which had just been formed on December 10, 2013 have conducted 4 (four) meetings to review Company’s investment plan in infrastructure.

Remuneration Policy

The Company has a remuneration policy for the Investment and Strategy Committee. The amount of remuneration adapted to the arrangement at the Board of Commissioners and Board of Directors level. For year 2014, the remuneration for the Investment and Strategy Committee is in the form of special allowance, amounted to Rp 5 million per month.

CORPORATE SECRETARY

The Corporate Secretary has a strategic position, which is implementing function to ensure compliance and of decision making administration in the Company, and conducting communication function in order to build a good relationship outside the Company. From the point of view of governance structure, the Corporate Secretary functions as function extension of the Board of Directors in conducting communication functions. Through that function, the roles of the Corporate Secretary are to ensure excellent communication between the Company and stakeholders, and guarantee the information availability that is accessible by the stakeholders according to the fair needs of stakeholders.

The Corporate Secretary is responsible to the Board of Directors and reports the task administration to the Board of Directors. The Company has assigned Dahlia Evawani, as Corporate Secretary based on the Director’s decree of July 30, 2013. The Profile of Dahlia Evawani can be seen in annual report 2014 on profile Company’s page. In accordance to regulations set by Bapepam-LK, the Corporate Secretary functions as liaison officer between the Company and shareholders, the capital market authority and other related parties.

In conducting her tasks, the Corporate Secretary is responsible to:

- Adept with capital market development especially applied regulations in capital markets;

- Provide services to the public for any information the needed by the investors related to the condition of Company;

- Provide inputs to the Company’s Directors to adhere to the constitution number 8, 1995 about the Capital Market and its implementing regulations;

- As liaison officer or contact person between the Company with the Capital Market Authority and the public;

- Prepare special lists related with Directors, Board of Commissioners and their family in the Company and its affiliation which covers share ownership, business relationship and other roles causing conflict of interests with the Company;

- Prepare the list of share ownership including 5% of ownership or more;

- To be responsible in GMS administration.

Work Program 2014

The Corporate secretary is responsible for delivering material information to all stakeholders punctually, accurate, accountable by always emphasizing the openness principle. Activities conducted in 2014 are as follows:

- To conduct GMS implementation.

- To conduct AGMS implementation.

- To conduct exposure of annual GMS.

- To present audited Annual Report and Financial Report to the Financial Service Authority and Indonesian Stock Exchange

- To attend the meetings of the Board of Commissioners and Joint meetings of the Board of commissioners and Directors and summarize meeting results.

- To become a coordinator for all Audit Committee activities.

- To conduct compliance report to regulators.

- To conduct information openness for each corporate actions conducted by subsidiaries.

- To conduct communications with the Financial Service Authority, Self Regulatory Organization (SRO) (IDX, ISCC, ICSA) and other related parties.

Corporate Secretary Competency Improvement Program

In 2014 the Corporate Secretary participated in many training programs, conferences, seminars or workshops, as follows:

| Date | Agenda and Activities |

| January 27 | Socialization of Director of PT Bursa Efek Indonesia decree regardingregulation amendement of number I-A about share listing equity share and stock issued besided stocks issued by listed Company. |

| February 13 | To deepen undertading of IDX Regulation 2014 as part of GCG. |

| February 21 | Socialisation of XBRL (eXtensible Business Reporting Language). |

| March 11 | Retribution socialisation by Financial Service Authority. |

| May 20 | Socialisation of Acceptance Information System of FSE and Emiten Reporting System or Public Company. |

| May 22 | Issuer Gathering: Seminar & Socialisation. |

| June 17 | Socialisation of new the PSAK and Focus Group Discussion (FGD) of FSE regulations. |

| July 2 | Business and Development Training. |

| July 3 | The latest Task and Function of Corporate Secretary Workshop. |

| August 18 | Workshop Economic Outlook Post Election 2014. |

| August 28 | Shariah Obligation Workshop (Workshop of Introduction of Shariah Bond). |

| September 17 | Investor Summit and Capital Market Expo 2014. |

| September 26 | PR & Corporate Communication. |

| October 29 | How to Develop An Excellent Annual Report. |

| November 20 | Intellectual Discussion: Indonesian Economic 2015; hopes and challenges. |

| December 16 | Corsec & Corcomm Gathering 2014. |

INTERNAL AUDIT

Internal audit is an assurance convincing activity and providing consultation independently and objectively, with the purpose to improve the value and amend the Company operations, through systematic approach, by evaluating and improving risk management effectivity, controlling, and excellent corporate governance process. Bapepam-LK regulations oblige the establishment of an Internal Audit Unit by the Company which has its shares registered in the Indonesian Stock Exchange.

Internal Audit Guidelines

The Internal Audit conducts their functions in implementing the audit process to ensure that the Company’s operational system works based on updated Audit Internal Charter on August 11, 2011 and approved by the Board of Commissioners and Directors. This charter has met the required regulations by Bapepam-LK, that generally covers the purpose of an Internal Audit; Scope of Work; Independency; Position and Structure; Accountability; Responsibility; Authority; Qualification; and Code of Conduct and Audit Administration Standard. In conducting their tasks and functions, the Company’s Internal Audit Department refers to the code of conduct and meet the International Standard for the Professional Internal Audit Administration of The Institute of Internal Auditors.

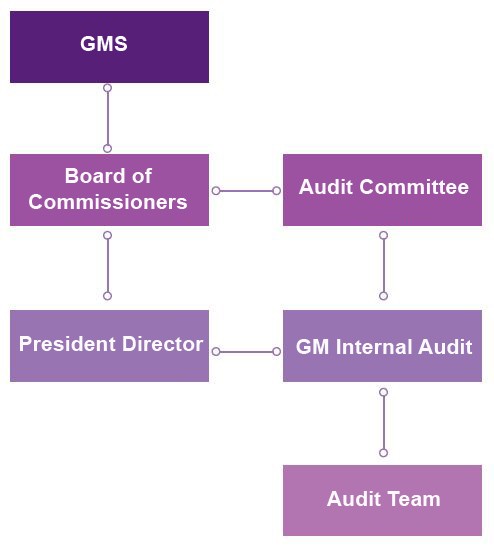

Independency, Position and Internal Audit Structure

The Company Internal Audit conducts an independent review function by checking and evaluating operational activities. To facilitate the Internal Audit Department Independency, Audit Internal staff report their task implementation to the Head of the Internal Audit. Administratively, HOIA report their task administration to a Main Director, and functionally report their task implementation to the Audit Committee.

The Internal Audit Department chaired by Head of Internal Audit is assigned and terminated by a Main Director with Board of Commissioners approval.

At the moment, the Head of the Company Internal Audit is held by Tony Utartono, CMA, CRMA, CFE. The Profile and brief history of Tony Utartono can be seen in the Company profile section. The Company Internal Audit Department supervise 3 (three) staff with their structural function as follows:

Responsibilities and Authorities

The coverage of the Internal Audit Department tasks is to establish whether the organizing structure of the risk management processes, control and governance, as designed and implemented by the management is adequate and functioning properly to ensure that:

- All existing risks have been identified and adequately managed.

- Interaction between Internal Audit Department with various unit manager (Governance Group) takes place as required.

- All information regarding the financial, managerial and operational activities that are important is presented accurately, reliably and in a timely manned.

- All employees act in accordance with policies, standards, procedures and laws and regulations which are in force.

- All of the resources are acquired economically, used efficiently, and adequately protected.

- All employees act in accordance with policies, standards, procedures and laws and regulations which are in force.

- All of the resources are acquired economically, used efficiently, and adequately protected.

- All programs, plans, and objectives of the Company can be achieved.

- The quality of the Company’s control process has been refined regularly.

- All matters concerning the laws and regulations that affect the Company have been identified and adequately anticipated.

The Head of the Department and all the staff of the Department of Internal Audit are responsible for:

- Develop and implement annual internal audit plan which has been approved, including special assignments or projects requested by the management or the Audit Committee.

- Test and evaluate the implementation of the internal control and risk management system in accordance with the Company policy.

- Conduct inspection and assessment of the efficiency and effectiveness of finance, accounting, operations, human resources, marketing, information technology and other activities.

- Suggest improvements and objective information about the activities examined at all levels of the management.

- Prepare audit report and submit the report to the President Director and the Board of Commissioners.

- Work closely with the Audit Committee.

- Monitor, analyze and report the implementation of the improvements that have been suggested.

- Develop a program to evaluate the quality of internal audit activities done.

- Constantly inform the development trend and successful practices in the areas of internal audit to the Audit Committee.

- Conduct special investigations as and when necessary.

In order for the Company’s internal audit process to remain independent and objective, the Head of Internal Audit and the entire staff of the Internal Audit Department do not have the right to perform operational duties or carry operational position in the Company or its affiliates; initiate or approve financial transactions outside the Internal Audit Department; and regulate the activities of the employees who do not take shelter under the Internal Audit Department except to the extent of those employees who are reasonably assigned to the audit team or help the internal auditors.

2014 Report on Implementation of Internal Audit Activities

Corporate Internal Audit Division activities in 2014 focused on evaluating the Company’s performance against the handling of systems and procedures. The Audit plan that has been developed is intended to manage and control any risks that have occurred, so that the negative impacts can be reduced to the minimum possible. Each internal audit finding is discussed and acted upon in order to ensure that the findings are not repeated as well as follow up of positive findings.

During the fiscal year 2014, the Internal Audit has conducted audits based on risk with a focus on the activities and processes that have high risks, such as: Income and Procurement Processes. In addition, the Internal Audit also helps to review some of the Standard Operating Procedures (SOPs), including SOP in Information Technology from the point of view of the Risk and Control Activities.

EXTERNAL AUDIT

In order to provide assurance to the public that the Company Financial Reports have been provided accurately, correctly and have met the standard of Indonesian Financial Accountancy, Financial Reports have to be audited by an independent external party which is the External Auditor so their providing an opinion on Company financial reports that independent objective.

In conducting their r tasks, External Auditors have the rights from the Company to access all the Company’s data, either financial data or other data. External Auditors who will be selected by the Company, must have criteria as follows:

- Have a good reputation and track record.

- Have experience in the infrastructure business.

- Do not have direct nor indirect relationships with the Board of Commissioners, Directors and other parties that can control the Company and also other parties that have interests with Company’s business activities.

- Registered as Public Accountant Offices in the Financial Services Authority.

For the external audit process for the Company financial report 2014, the Company assigned Public Accountant Office Tanubrata Sutanto Fahmi & Partners (member of BDO), as AccountantFahmi, SE, Ak, CPA, CA. The Public Accountant Office assignment Tanubrata Sutanto Fahmi &Partners (member of BDO) as Company’s independent auditors is the third period, meanwhile accountant Fahmi, SE, Ak, CPA, CA handled the first period for Company’s financial report audit process. For other services that the accountant gave other than audit service of annual financial report are as follows:

- Interim consolidation financial report and report for interim financial information review on 30th of June 2013 and six month period that ends on that date (not audited).

- Independent Accountant Report Review for Performance Consolidation Financial Position Report on 30th of June 2013 PT Nusantara Infrastructure Tbk and its subsidiaries.

The Company’s financial report audit for fiscal year 2010 until 2014 consecutively conducted by the Public Accounting Office and accountants are as follows:

| Period | Registered Public Accountants | Accountants | Opinion |

| 2014 | Tanubrata Sutanto Fahmi & Rekan | Susanto Bong, SE, Ak, CPA, CA | Unqualified opinion |

| 2013 | Tanubrata Sutanto Fahmi & Rekan | E. Wisnu Susilo Broto, SE, Ak, CPA | Unqualified opinion |

| 2012 | Tanubrata Sutanto Fahmi & Rekan | E. Wisnu Susilo Broto, SE, Ak, CPA | Unqualified opinion |

| 2011 | Anwar & Rekan | Agustinus Sugiharto, CPA | Unqualified opinion |

| 2010 | Anwar & Rekan | Agustinus Sugiharto, CPA | Unqualified opinion |